There has been a lot of discussion in Norman about the University North Park development and Tax Increment Financing. First, the UNP and the TIF are not the same. The UNP is the development and the TIF is the public works and community common areas’ financing tool.

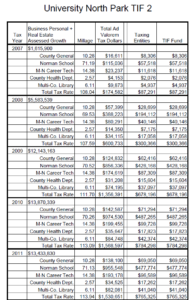

The TIF 2 started in 2007 and had a base total assessed value of $905,128 (this is not the ad valorem tax). The TIF 2 agreement is a 50/50 split. 50% of the collected assessed value above $905,128 goes to pay for the TIF projects and 50% goes to the ad valorem taxing entities. Below are pictures of a chart showing the performance of the TIF 2.

The TIF 2 agreement is a 50/50 split. 50% of the collected assessed value above $905,128 goes to pay for the TIF projects and 50% goes to the ad valorem taxing entities. Below are pictures of a chart showing the performance of the TIF 2.

The TIF 2 agreement is a 50/50 split. 50% of the collected assessed value above $905,128 goes to pay for the TIF projects and 50% goes to the ad valorem taxing entities. Below are pictures of a chart showing the performance of the TIF 2.

The TIF 2 agreement is a 50/50 split. 50% of the collected assessed value above $905,128 goes to pay for the TIF projects and 50% goes to the ad valorem taxing entities. Below are pictures of a chart showing the performance of the TIF 2.In 2006 the TIF Economic Analysis Project Plan (April 10, 2006) stated the TIF 2 Development area would generate $5,308944 in total ad valorem collected or an estimated $49,100,500 in business property & real estate assessed value. The TIF 2 ad valorem collections are underperforming by 40% of what was projected. However, the growth over 10 years is 1,750% but projected to grow 2,941%.

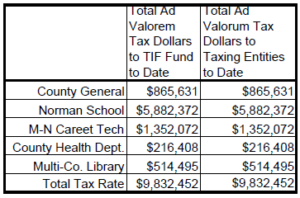

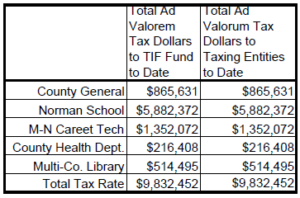

Through 2017 the total ad valorem collected is $19,664,904 of which the TIF projects got 50% or $9,832,452 and County General (County Government Operations) – $865,631, NPS – $5,882,372, Moore/Norman Technology Center – $1,352,072, County Health Department – $216,408 and Pioneer Library – $514,495.

By contrast, the Center City TIF has a 90/10 split so the ad valorem taxing entities only get 10% of the increment collected ad valorem tax. TIF’s can extend for 25 years or until the project cost is fully paid. The new TIF north of Rock Creek is being purposed at 80/20 for the first 5 years, then 60/40 for the remained.

Tax Increment Financing can be a valuable financing tool for economic development. One way to think of it is; property generating XXX value in property taxes currently and without any development by the private sector is low and has no potential for growth. So in order to encourage private development, public works projects or private/public partnerships are planned and presented to provide the tax revenue for improvements, public streets, parks and or public buildings. It is a way of self-funding within the TIF area and has buy-in from the private investment development community.

As an ad valorem taxing entity, the County is part of the Statutory Committee. By being a part of the committee, the County is negotiating that best works for the County budget to provide services. This does not endorse or support the TIF proposal. The development area and development projects are separate and can be supported by individual County Officials.